Was ist CLV?

Der Customer Lifetime Value (CLV) als Metrik der Kundenbewertung zeigt auf, wie wertvoll die Kundenbeziehungen sind, und liefert so Aufschluss über den Wert des gesamten Kundenstamms eines Unternehmens. Damit dient er nicht nur als Indikator der Profitabilität und somit als strategische Kontrollgrösse des Relationship Marketing. Auch Entscheide operativer Natur, wie die Kundenauswahl für Marketingmassnahmen, können so datengetrieben unterstützt werden.

CLV als Massstab erfolgreicher Kundenbeziehungen

Unternehmen sind dann erfolgreich, wenn es ihnen gelingt, langfristige profitable Kundenbeziehungen zu etablieren. Der Customer Lifetime Value (CLV) ist die Ziel- und Steuerungsgrösse, die eine Ausrichtung von Unternehmen an langfristig erfolgreichen Kundenbeziehungen ermöglicht. Mit CLV ist der Wert (gemessen am Umsatz oder Profit) gemeint, den ein Kunde über die gesamte Beziehungsdauer für ein Unternehmen generiert (in der praktischen Umsetzung häufig eine bestimmte Zeitdauer).

Vereinfacht: Wenn ein Kunde 10 Jahre bei einem Unternehmen ist und pro Jahr für 1'000 CHF Produkte oder Dienstleistungen des Unternehmens in Anspruch nimmt, liegt sein (umsatzbezogener) CLV bei 10'000 CHF. Der CLV besteht also aus einer Zeitkomponente und einer Wertkomponente. Wichtig zu betonen ist, dass mit «Lifetime» nicht die Lebenszeit des Kunden, sondern die Beziehungsdauer und somit die Lebenszeit der Kundenbeziehung gemeint ist. Häufig wird bei der CLV-Analyse eine begrenzte Zeitdauer betrachtet, da eine zu langfristige Betrachtung weder methodisch noch im Hinblick auf die zu treffenden Entscheidungen zweckmässig ist.

Vorteile und Nutzungsmöglichkeiten des CLV

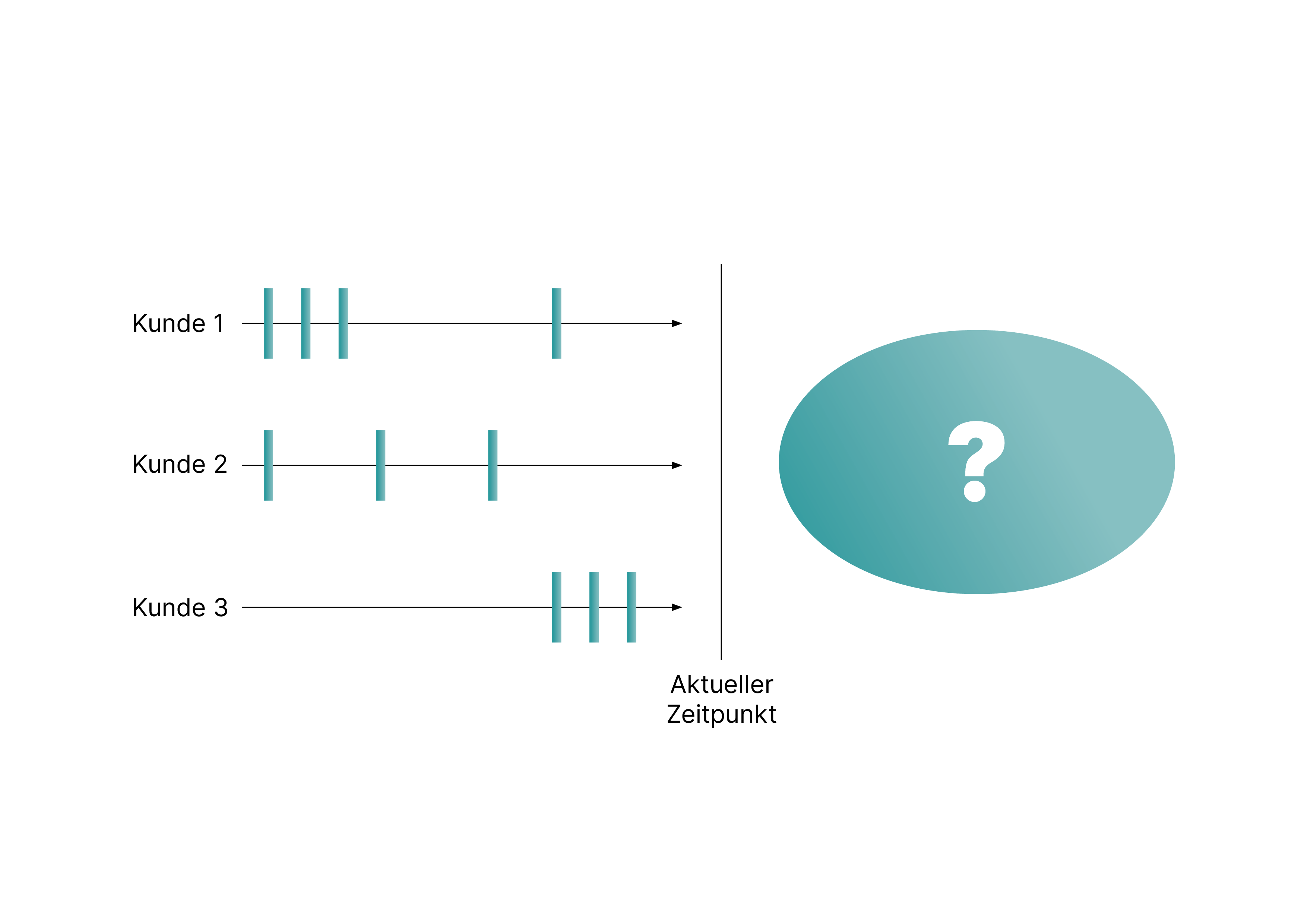

Warum hat der CLV eine so hohe Relevanz für Unternehmen? Bei einer kurzfristigen Wertbetrachtung, wie sie häufig angewandt wird – etwa indem die aktuellen Umsätze/Profite auf Basis des Vorjahres betrachtet werden – wird vernachlässigt, dass sich Kundenbeziehungen ganz unterschiedlich entwickeln können. Man spricht hier von unterschiedlichen «Beziehungsmustern» (vgl. Abb. 1). Manche Kunden kaufen zum Beziehungsstart intensiv, brechen dann aber die Beziehung wieder ab. Andere Kunden probieren zunächst vorsichtig und werden zu langfristig wertvollen Kunden. Viele Kunden werden erst nach einer gewissen Zeit profitabel – wenn die Marketing-/Akquisitionskosten richtig zugeschlüsselt werden.

Eine CLV-Betrachtung hilft Unternehmen, sich auf langfristigen Erfolg statt auf kurzfristige Verkäufe zu fokussieren.

Varianten des CLV und ihre Anwendung

Umsätze vs. Profits

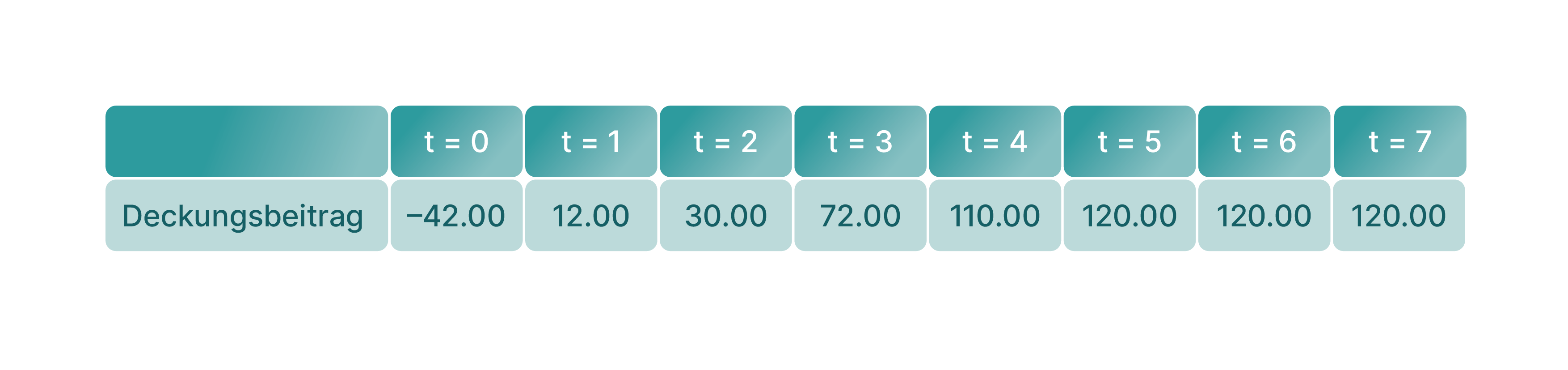

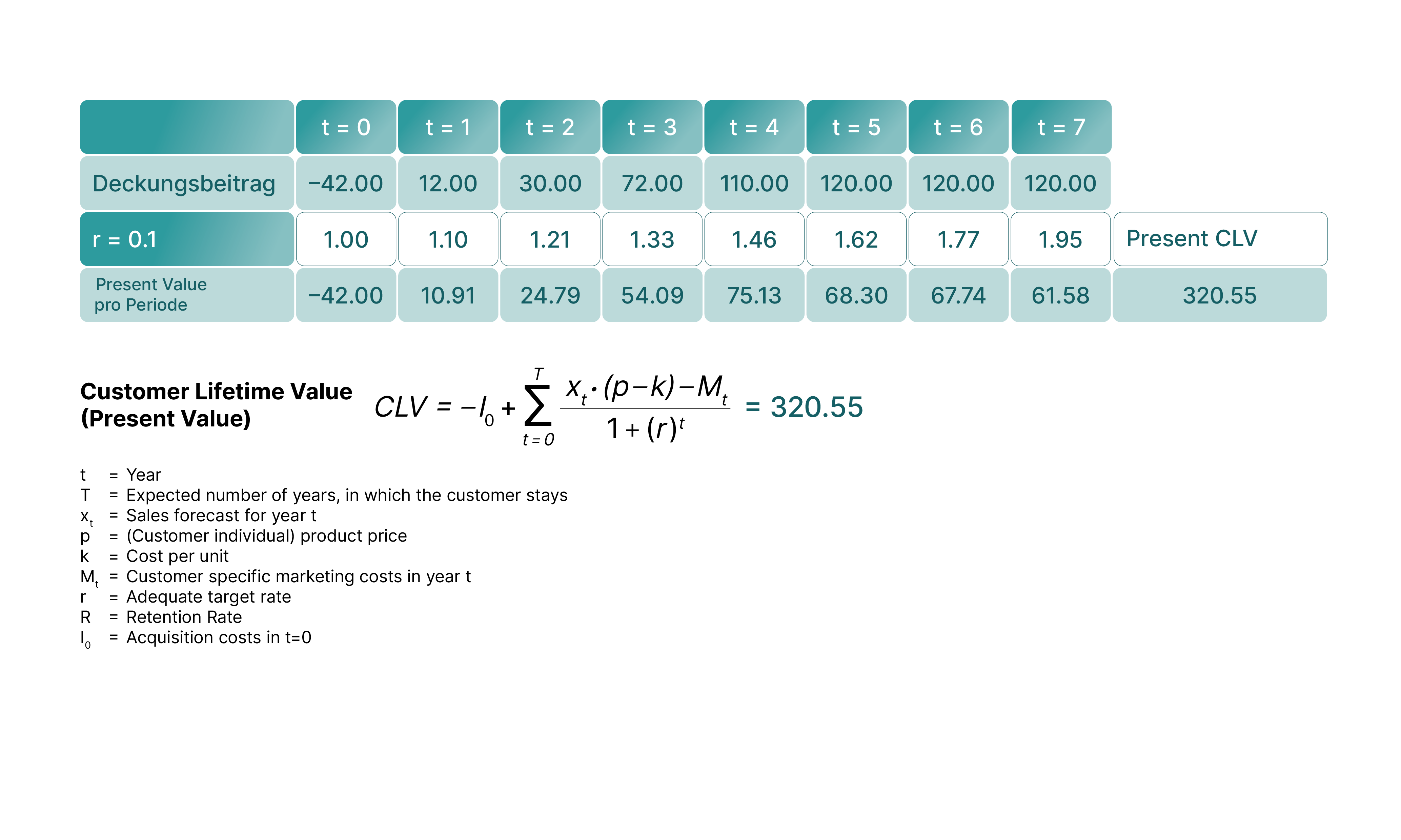

Bei der Wertkomponente des CLV können wie bei einperiodigen Kundenwertansätzen entweder reine Umsatzbetrachtungen oder unter Berücksichtigung der Kosten eine Deckungsbeitrags- bzw. Profitbetrachtung vorgenommen werden. Letzteres ist insbesondere sinnvoll, wenn sich die Kosten pro Kunde stark unterscheiden (z.B. Produkt-, Betreuungs-, Marketingkosten). In vielen Unternehmen ist es aber nur schwer möglich, Kosten den einzelnen Kunden zuzuschlüsseln.

Konstante vs. variierende Wertbeiträge

Im Eingangsbeispiel wurde von konstanten Wertbeträgen (1'000 CHF Umsatz pro Jahr) ausgegangen. In einigen Geschäftsmodellen ist diese Annahme nicht unrealistisch, etwa bei relativ einfachen Abo-Modellen (z.B. Netflix). In diesen Fällen variieren die CLVs lediglich in Abhängigkeit von der Beziehungsdauer. In vielen anderen Fällen (z.B. im Detailhandel) können die Umsätze eines Kunden im Zeitablauf stark variieren. In diesen Fällen ist eine Betrachtung der individuellen Umsätze pro Periode erforderlich, wie in Abb. 2 dargestellt.

Past vs predicted CLV

Die bisherigen Ausführungen sind von einem vergangenheitsorientierten Wertansatz (Past CLV) ausgegangen. Dieser ist rückwirkend zur Bewertung einzelner Kundenbeziehungen sowie des gesamten Kundenstamms geeignet. Es können Aussagen darüber getroffen werden, welchen Wertbeitrag einzelne Kundenbeziehungen bisher geleistet haben.

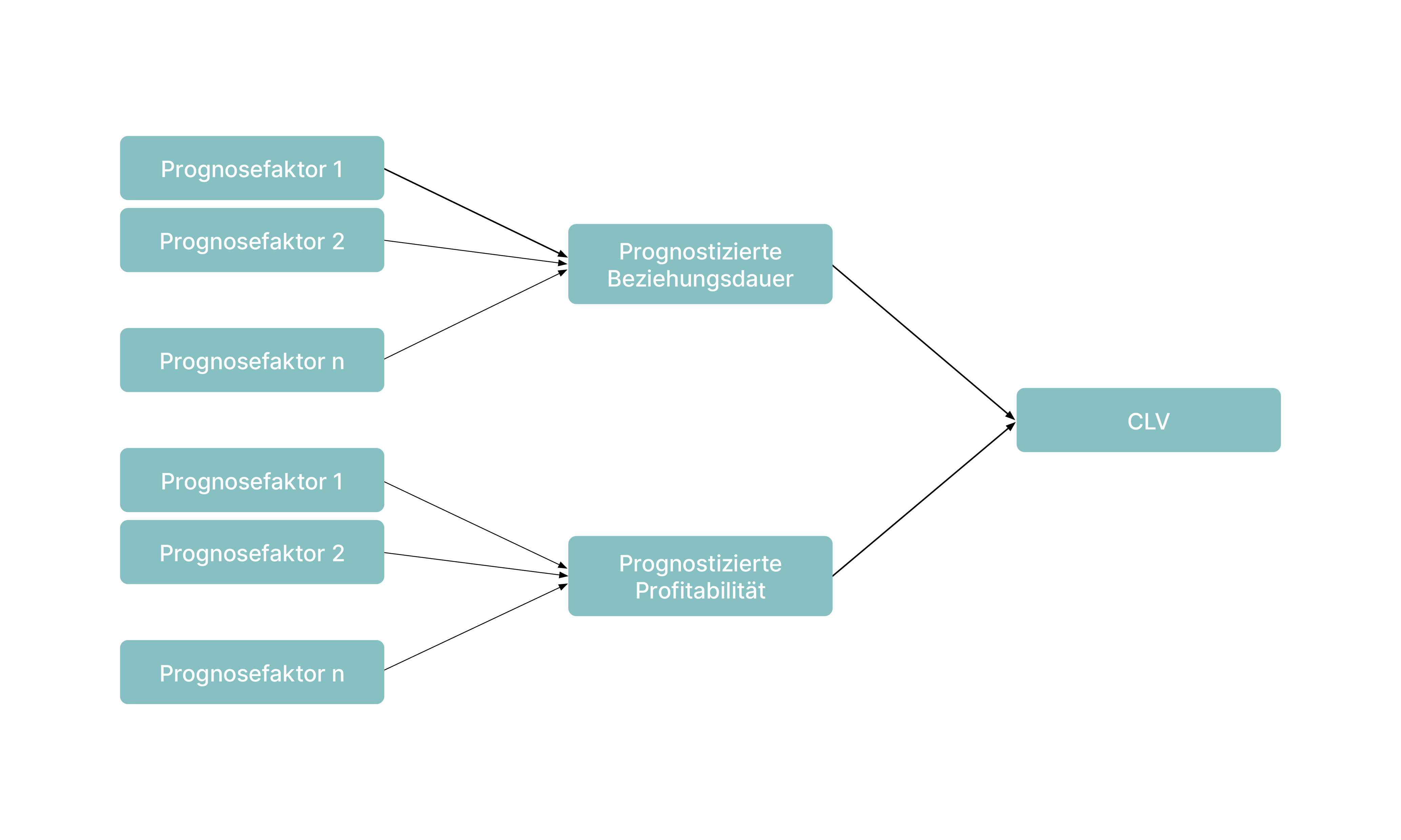

Sollen mit dem CLV Investitionsentscheidungen getroffen werden (In welche Kundenbeziehungen soll mehr oder weniger investiert werden?), ist der Past CLV nur bedingt aussagekräftig. Denn es soll ja in jene Kunden investiert werden, die zukünftig am meisten Potenzial haben. Hier kommt der zukunftsorientierte Wertansatz (Future oder predicted CLV) zum Tragen. Hierbei wird der zukünftige Kundenwert mit Data-Science-Ansätzen geschätzt. Hierzu werden Prognosefaktoren beigezogen, d.h., Indikatoren, anhand deren Aussagen über den zukünftigen Wert getroffen werden können. Dies sind etwa:

- Bisheriges Kundenverhalten: Auch wenn davon auszugehen ist, dass sich Kundenbeziehungen nicht immer gleichförmig weiterentwickeln, ist das bisherige Kaufverhalten durchaus ein relevanter Prognosefaktor.

- Persönliche Kundenmerkmale: Diverse persönliche Merkmale der Kunden können bei der Prognose des Kundenwerts helfen. Dazu gehören Alter, Einkommen, Wohnort, Zahl der Kinder und Ähnliches. Nicht immer sind diese Informationen vorhanden. Für Unternehmen ist es daher von Interesse, solche Informationen nach Möglichkeit zu beschaffen.

- Akquisitionskanal: In diversen Studien wurde die Prognosekraft des Akquisitionskanals identifiziert. So kann beispielsweise die Akquise im Rahmen einer Rabattaktion auf einen geringeren zukünftigen Wert hinweisen, während eine Akquise über Empfehlungen im Bekanntenkreis in Studien einen positiven Einfluss auf den Kundenwert hatte.

- Und vieles mehr.

Häufig werden die Zeit- und die Wertkomponente des CLV gesondert prognostiziert, und davon ausgehen wird der Predicted CLV abgeleitet.

Bei der Ermittlung des zukünftigen CLV sind – um investitionstheoretisch korrekt zu sein – strenggenommen Abzinsungen der zukünftigen Werte vorzunehmen, um den sog. Present CLV abzuleiten.

Einzelkunden vs. Kundensegment

Die Königsdisziplin des CLV ist natürlich die Bestimmung von individuellen Kundenwerten. Für manche Entscheidungen kann es aber ausreichen oder sogar sinnvoll sein, einen Kundensegment-CLV zu betrachten. Wenn etwa bekannt ist, dass ein bestimmtes Kundensegment einen sehr hohen durchschnittlichen CLV aufweist, kann diese Information Unternehmen dabei helfen, dieses Segment prioritär im Rahmen des Marketing anzusprechen. Im Rahmen der Neukundenakquisition sind über potenzielle Kunden häufig wenige individuelle Informationen vorhanden. Eine wertorientierte Fokussierung auf bestimmte Segmente bringt Unternehmen damit bereits einen wesentlichen Schritt weiter.

Herausforderungen und Zukunftsperspektiven

Unternehmen stehen im Zusammenhang mit CLV-Ermittlungen und -Anwendungen vor diversen Herausforderungen. Einige davon sind die folgenden:

- Nicht immer ist es sinnvoll, kundenbezogene Entscheidungen auf Basis des CLV zu treffen. Der Kundenwertmanager einer Fluggesellschaft berichtete von einer Gegebenheit, als die Check-In-Angestellte ein Upgrade vergeben konnte, und dies nach dem CLV vorgenommen werden sollte. Vor ihr standen zwei Passagiere: eine betagte Vorstandsvorsitzende und eine junge Nachwuchsführungskraft. Letztere hatte rein altersbedingt im System einen höheren CLV zugewiesen erhalten. Wem sollte das Upgrade gewährt werden?

- CLV-Ermittlungen und insbesondere die Bestimmung des Future CLV sind mit hohen Daten- und Analyseanforderungen verbunden. Der Aufwand, diese zu erfüllen, lohnt sich aber. Und von neuen methodischen Ansätzen im Bereich Machine Learning und AI profitieren auch CLV-Analysen.

- Wenn auf Basis des Predicted CLV Entscheidungen getroffen werden, sollten diese im Normalfall einen Einfluss auf das Kundenverhalten und damit wiederum auf den Predicted CLV haben. Diese analyseimmanenten Abhängigkeiten müssen genau genommen in den CLV-Modellierungen berücksichtig werden.

Durch Machine Learning und AI ergeben sich ganz neue Potenziale für den CLV!

Solche und ähnliche Herausforderungen und Fragestellungen machen den CLV zu einem zukunftsträchtigen Forschungsgebiet, in dem noch zahlreiche Fragen angegangen werden können.

Möchten Sie mehr zum Thema Kundenwert erfahren? Kontaktieren Sie die Experten persönlich: georgi@customer-metrics.io; adriana.ricklin@hslu.ch

Weiterführende Literatur

- Bruhn, Manfred; Georgi, Dominik; Treyer, Mathias; Leumann, Simon

(2000): Wertorientiertes Relationship Marketing. Vom Kundenwert zum Customer Lifetime Value, in: Die Unternehmung, 54. Jg.(2000), Nr. 3, S. 167–187. - Bruhn, Manfred (2022): Relationship Marketing, 6. Aufl., München.

- Georgi, Dominik (2000): Entwicklung von Kundenbeziehungen, Wiesbaden.

- Georgi, Dominik (2007): Werttreiber in Kundenbeziehungen, Habilitationsschrift Universität Basel.

- www.hslu.ch/de-ch/wirtschaft/institute/ikm/

- www.customer-metrics.io